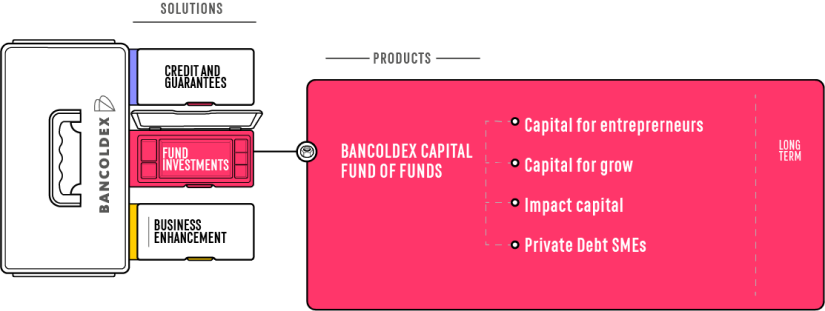

Financial solutions through equity and quasi-equity in which Bancóldex acts as a limited partner (investor) in private equity funds, as well as promoter of the local and regional industry.

Financial solutions through equity and quasi-equity in which Bancóldex acts as a limited partner (investor) in private equity funds, as well as promoter of the local and regional industry.

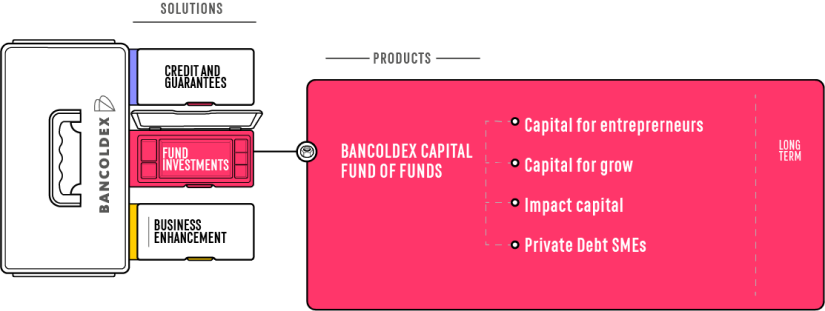

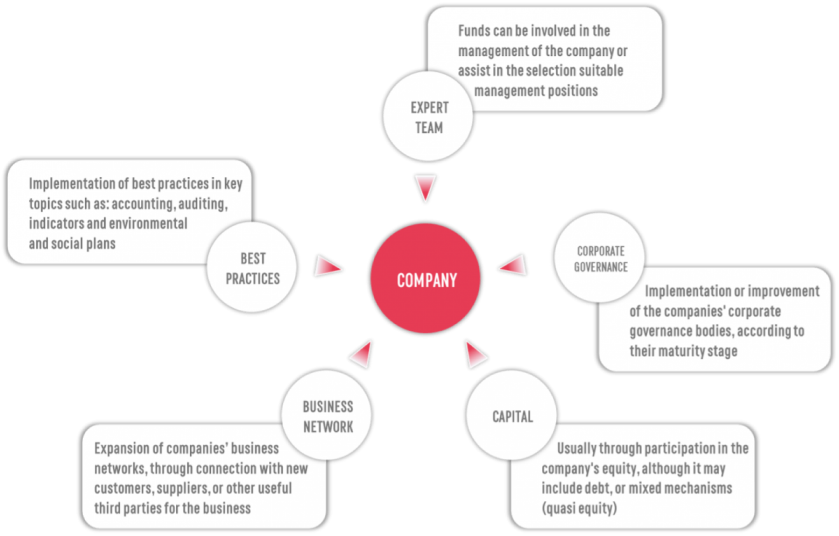

Private equity funds are a strategic ally in the growing path of business. The companies that receive an investment from a fund additionally obtain a value-added scheme, such as the implementation of good practices in corporate governance, knowledge in human talent management, expansion of business networks, support in business administration, among others.

This value-added scheme is also called “smart money”

Every fund has an expert investment management team (General Partner), who oversees the selection the companies and projects that receive the fund's resources, always with the aim of obtaining a return from the value generation in them.

Various types of funds are usually grouped under the category of Private Equity; for example, these can be differentiated according to the stage of maturity of the companies in which they invest, including:

Although the main investment instrument of a fund is equity or quasi equity, they can also use debt instruments to finance companies. Thus, there are funds dedicated exclusively to financing companies through Private Credit. These may be focused on: i) ventures that are not served by the traditional financial system or ii) mature companies that already have high bank indebtedness and require another source of financing. The debt of a private credit fund tends to differ from that of the traditional financial system, in that it is long-term, structured, and with more complex guarantee mechanisms.

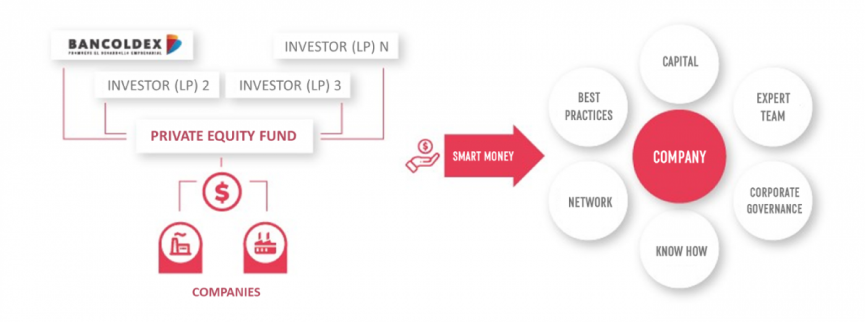

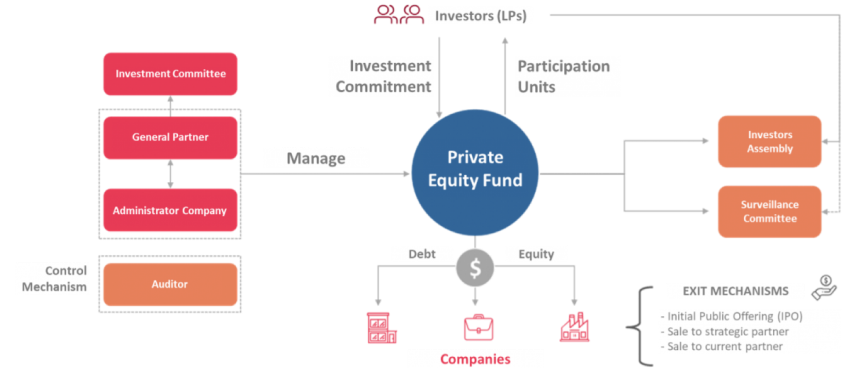

The foundations of the private equity industry in Colombia began to be forged in 2005, based on the first regulatory guidelines that would later allow, in 2010, the issuance of Decree 2555, which dictates the general rules under which they must operate, as well as the minimum corporate governance bodies, and the rights and obligations of each party involved.

Standard model of a fund in Colombia

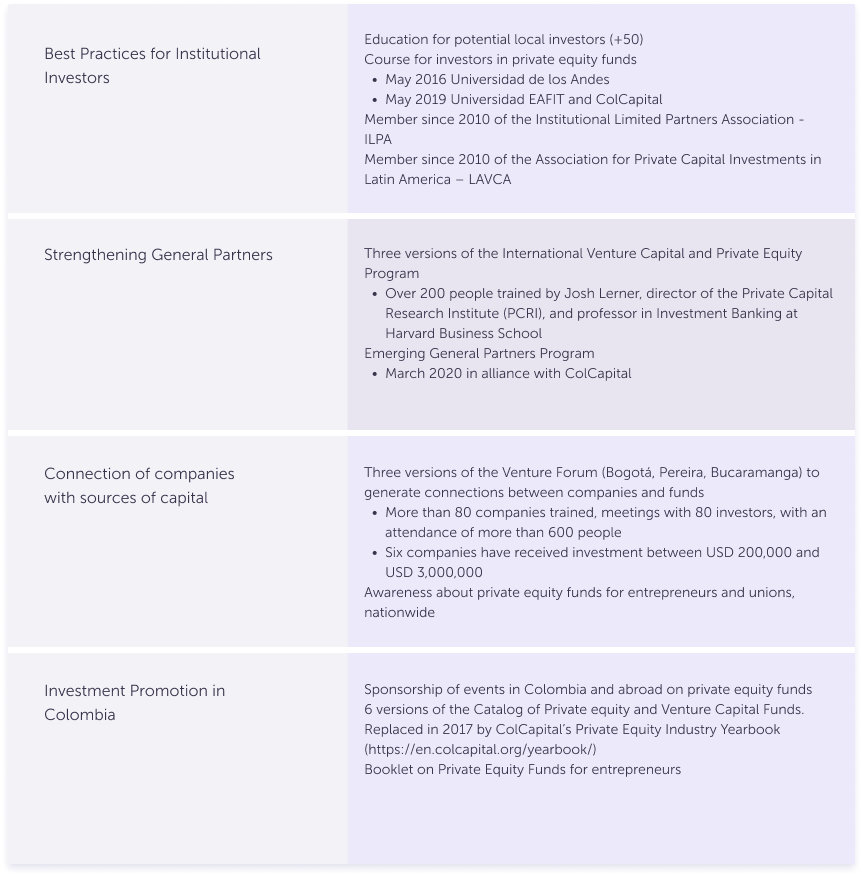

With the aim of contributing to the development of the local private equity ecosystem, Bancóldex has promoted:

Additionally, in 2012, in conjunction with IDB Lab and supporting 26 general partners, Bancóldex promoted the creation of the Colombian Association of Private Capital - ColCapital, whose mission is to “Encourage, develop and promote in an integral way the industry of Private Equity Funds in Colombia, as an engine of collective savings and economic growth, under the highest management standards”.

You can find more information about private equity funds in Colombia on the association`s website COLCAPITAL

Private equity funds are a strategic ally in the growing path of business. The companies that receive an investment from a fund additionally obtain a value-added scheme, such as the implementation of good practices in corporate governance, knowledge in human talent management, expansion of business networks, support in business administration, among others.

This value-added scheme is also called “smart money”

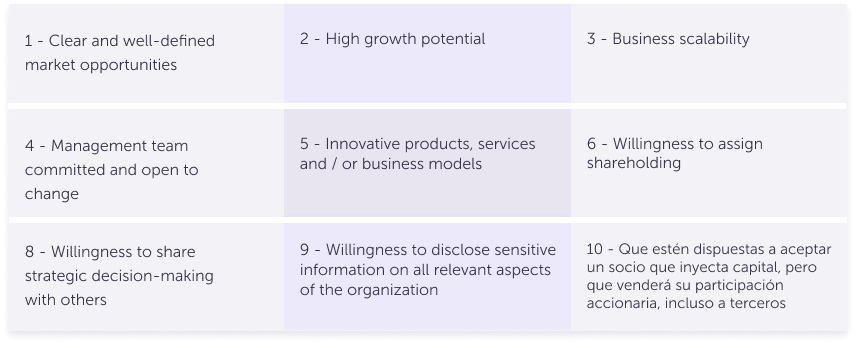

Private equity funds seek to invest in companies to obtain profitability from the generation of value in them, so the following are examples of criteria that a fund evaluates when investing in a company:

Likewise, each fund has an investment policy, which defines the principal aspects that they consider selecting potential investments, for example: economic sectors, minimum size and level of sales of the company, stage of development of the company, geographic coverage, and targeted shareholding participation of the fund in the company (majority or minority).

If you are a company and want to know more about the most common characteristics that private equity funds look for in companies, as well as where to contact them, please consult the following booklet:

https://www.bancoldex.com/sites/default/files/cartilla_fondos_de_capital.pdf

Also, you can find additional information on general partners and funds operating in the country, through the Colombian Association of Private Capital, ColCapital, at: https://colcapital.org/

As part of Bancóldex commitment to generate connections between businesses and alternative sources of capital; we invite those companies that consider private equity funds as a potential ally for their growth to fill out the following form, which aims to collect relevant business information, to be shared with general partners operating in Colombia.

Connection Form

* Bancóldex acts as a connection bridge, but whoever decides whether to contact the company will be the general partner of the fund, who will review the information, and if it matches its policies and investment objectives, will contact the company directly.

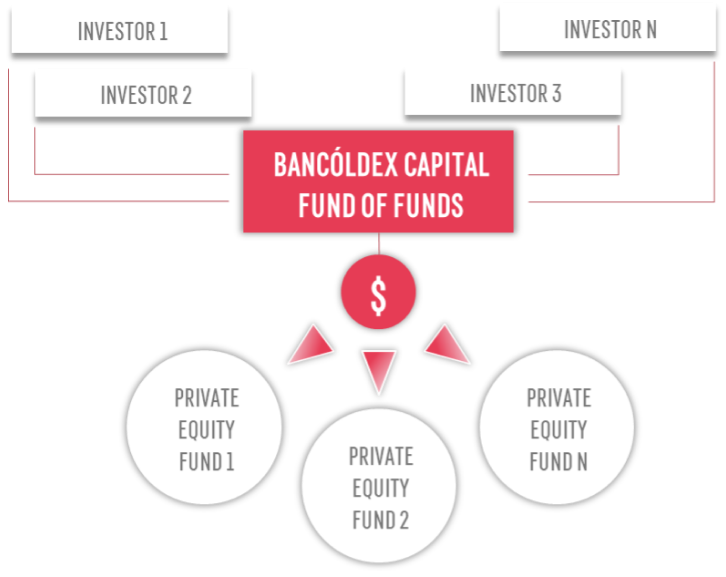

Bancóldex Capital Fund of Funds allows the mobilization of resources of different kind of investors towards the Private Equity industry in Colombia and the region (Latin America), and thus develop alternative financing mechanisms for entrepreneurs and companies.

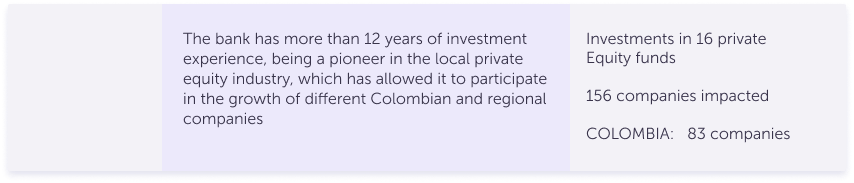

Bancóldex acts as the General Partner, selecting and monitoring investments in underlying private equity funds. Likewise, it provides resources to the vehicle, as an anchor investor.Proven investment experience - Bancóldex

Other relevant figures:

$ Average investment in COL: COP 15.007 m / company

Distribution by company’s size:

Micro – 9.9% Medium – 32.4%

Small – 25.4% Large – 32.4%

Average 198 employees / company

Gender. Women are:

35% of total Jobs

25% of senior management positions

To achieve the stated investment objectives, Bancóldex has the following strategic pillars:

Robust investment process that aims to evaluate the investment opportunities considering five main vertices: team, investment policy, track record, processes and, terms and conditions.

Investment Committee composed of expert and independent members that generate value in investment decision making process.

Detailed monitoring and follow-up process for each investment, their underlying assets, and general partners.

Seasoned investment professionals.

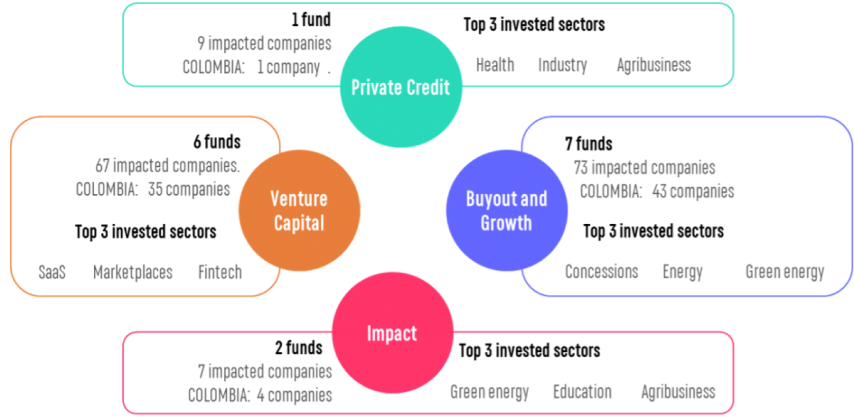

Bancóldex Capital Fund of Funds allows the investor to choose between various investment theses, according to their strategic interests:

Capital to Grow (ESP: “Capital para Crecer”)

Funds that invest, through debt or equity, in medium and large companies, with proven market track record, that require resources mainly for consolidation and expansion plans at a regional or global level.

Capital for Entrepreneurs (ESP: “Capital para Emprender”)

Funds that invest, through debt or equity, in innovative early-stage companies that have financed their first operational phases, have a proven product and have achieved their first income.

Impact Capital (ESP: “Capital de Impacto”)

Investment in Impact Funds:

Funds that invest, through debt or equity, in companies, usually early stage, whose business models allow positive social or environmental impact

Private Credit (ESP: “Deuda Privada”)

Funds that carry out private credit transactions (senior, subordinate, with or without guarantee, mezzanine, among others) to companies with a track record in the market.

In general, the targeted funds must meet the following minimum characteristics:

Other investment terms

Commitment size

USD 500k to USD 10 million

Maximum participation

25% of the fund’s size

Commitment currency

COP or USD

*If you are a general partner looking for limited partners, contact us to learn about your investment proposal.

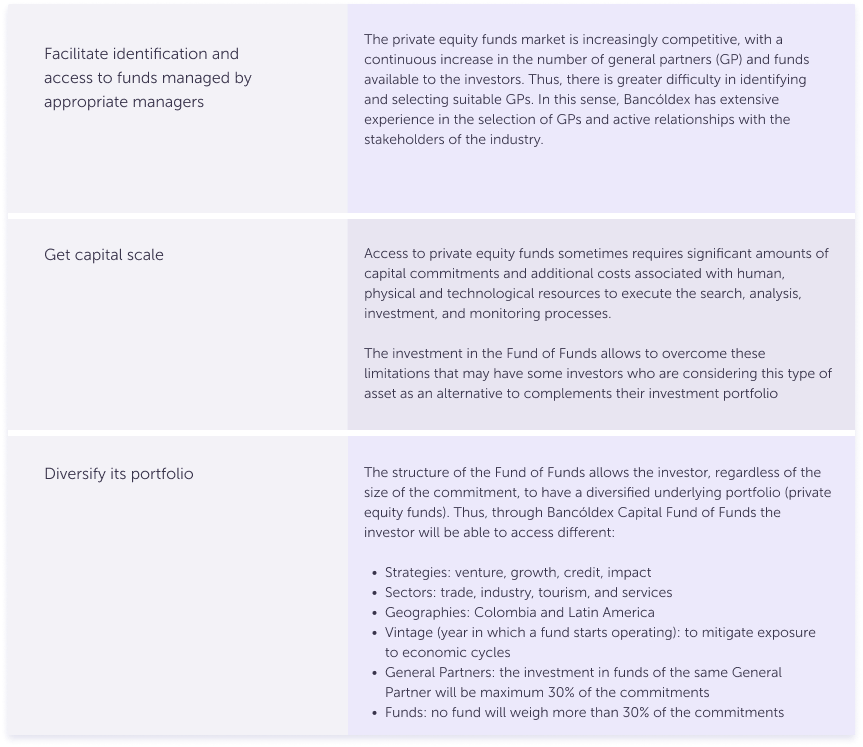

Bancóldex Capital Fund of Funds is open to different types of investors, local and international, which allows them, among other things:

If you are an investor looking for investment opportunities in private equity funds, contact us to learn about our value proposition.

Bancóldex has a team exclusively dedicated to the management of Bancóldex Capital Fund of Funds. This is responsible for assessing investment proposals in private equity funds and presenting them for approval by the Investment Committee, as well as managing and monitoring the current portfolio.

The team has a joint experience of more than 40 years related to private equity funds.

Financial Vice-president - CFO

Claudia M. González

Industrial Engineer from Universidad de los Andes, with experience in financial management with emphasis in the areas of treasury, financial sector, and stock markets. Certification in Private Equity funds from EAFIT University and ColCapital.

At Bancóldex she has served as Treasury Director and Financial Vice-president, roles in which she has led investment decision processes, trading, deposits, portfolio disbursements and creating new products strategies. Additionally, she is responsible for Bancóldex's financial and tax planning, as well as its financial projections.

She is responsible for the PE & VC Team, supporting them in making investment decisions and monitoring the portfolio, as well as in the structuring and implementation of new investment strategies of the Fund of Funds.

Head of Private Equity Funds KEY PERSON

Ana Margarita Coronado Gomez

Business Administrator with a Corporate Finance specialization and an Executive MBA from Pontificia Universidad Católica del Perú, EADA Business School and University of Miami. She holds a Certification of the Venture Capital Institute Program in Atlanta.

27 years of experience, in positions in commercial banking, pension fund management, and development banking. 5 years’ experience in corporate credit, she also worked for 12 years at AFP Colfondos (private pension fund manager) as Credit Risk Director, responsible of risk control of the invested portfolios, including investments in private equity funds. In May 2013, she started to work at Bancóldex as the Head of the Private Equity Funds Department.

In her role as Key Person, she will dedicate the time necessary for the affairs of the Fund of Funds in accordance with the level of diligence required of an expert administrator of private equity funds.

Senior Portfolio Manager

Guillermo Martínez Rojas

Professional in Finance and International Relations from Externado University of Colombia, Master’s in Business Management from Universidad Anáhuac México.

More than 14 years of work experience, in positions in investment banking, commercial banking, pension administrator, and development banking. He has nearly 10 years of relevant experience in private equity funds, through the search, study, and monitoring of national and international funds, with diverse focuses, including buyout, infrastructure, senior debt, mezzanine, venture capital, and real estate, as well as secondaries and funds of funds.

At Bancóldex he is the leader of the portfolio managers and associates’ team, ensuring the comprehensive due diligence of private equity funds that meet the investment criteria of the Fund of Funds, in order to have an optimal construction of an investment portfolio; and timely monitoring of the performance of these.

Portfolio Manager

Jaime E. Diaz

Economist with an emphasis on international finance from Universidad La Sabana, Master’s in Strategic Business Administration from Pontificia Universidad Católica del Perú and Master’s in Innovation and Sustainability from EADA BS Barcelona.

10 years of experience in the Colombian financial sector, of which 7 have been in the search, due diligence, structuring, and monitoring of private equity funds and other alternative assets, as well as the companies / projects in which they invest, both in Colombia and globally.

At Bancóldex he is responsible for the search, pre-selection, and due diligence processes of private equity funds. Likewise, he monitors the performance of said portfolio; and assists the management team in structuring programs for the development of the local private equity industry.

Portfolio Manager

Erika Martinez R.

Professional in Finance and International Trade and specialist in Economic Law and Evaluation of Investment Projects from Universidad del Rosario.

12 years of work experience in financial risk management, asset valuation, stock market and alternative assets. She worked for 6 years at AFP Skandia (private pension fund manager) in charge of the processes of identification, measurement, control, and monitoring of financial risks related to local and international private equity funds, as well as other alternative assets and international funds.

At Bancóldex she is responsible for the search, pre-selection, and due diligence processes of private equity funds. Likewise, she monitors the performance of said portfolio; and assists the management team in structuring programs for the development of the local private equity industry.

Portfolio Manager

Natalia Tamayo Múnera.

Professional in Financial Engineering and Corporate Finance specialist from Antioquia School of Engineering.

13 years of work experience mainly as a stock brokerage, holding positions of strategic asset allocation, asset analyst, and portfolio management. She worked for about 4 years at AFP Porvenir (private pension fund manager) as a risk specialist for alternative assets and variable income, where she led the execution of due diligence for private equity funds, as well as portfolio monitoring.

At Bancóldex she is responsible for the search, pre-selection, and due diligence processes of private equity funds. Likewise, she monitors the performance of said portfolio; and assists the management team in structuring programs for the development of the local private equity industry.

Executive - Department of Private Equity Funds

Sebastián Bonilla B.

Industrial Engineer with emphasis in business administration and economics from Universidad de los Andes and candidate for a Master's Degree in Finance from Universidad de los Andes.

3 years of work experience in the Colombian financial sector - AFP Colfondos (private pension fund manager), carrying-out the due diligence process of local and international private equity funds, monitoring and tracking the respective underlying assets that make up the portfolio through risk identification and approach to mitigants.

At Bancóldex he leads the opportunity generation process (pipeline construction) and assists the Portfolio Managers in the due diligence and portfolio monitoring processes.

Titulo

Contact us

Learn more about Bancoldex solution portfolio

Be up to date with Bancoldex