As part of Bancoldex’ more comprehensive strategic front, we support internationalization processes and corporate exports in the country by promoting competitiveness in global markets we support internationalization processes and promote the Colombian exports, seeking to improve their competitiveness in global markets.

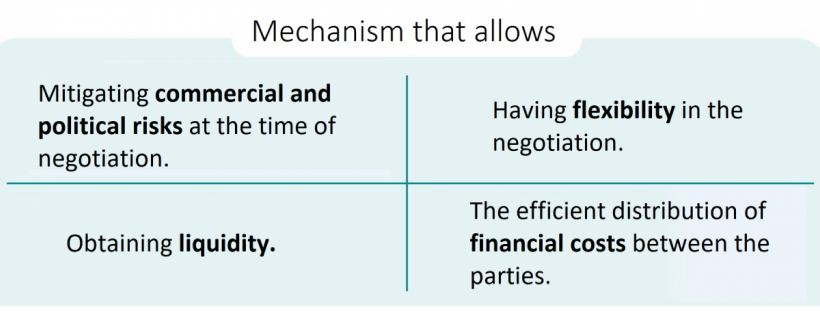

foreign trade finance is one of the credit solutions that we have designed especially specially designed to promote Colombian companies’ the export process of Colombian companies, and creating payment facilities options for their customers.

Credit line for buyers

Bancoldex finances payments made by international buyers of Colombian goods and/or services abroad through financial intermediaries domiciled within or outside the buyer’s country, using They may use bank payment instruments such as: term letters of credit, guaranteed bills of exchange, promissory notes, payment commitments, securities covered by stand-by guarantees, among others.

Financing for engineering, construction and other services projects

Under the same characteristics of the Buyer Credit Line, Bancoldex can also finance the development of engineering and / or construction projects abroad, carried out by Colombian companies.

When it comes to this type of project, the bankable amount may be:

- Up to 100% of the Colombian component of goods, services and inputs related to the project.

- Up to 50% of the component imported from third countries that are part of the project.

- Up to 85% of the local costs and expenses necessary for its execution.

The amount will also be due to the participation of the Colombian component within the total cost of the project, and to the approval terms of the respective Bancoldex credit instance.

Beneficiaries:

- Importer of engineering and / or construction projects carried out by Colombian companies.

- Colombian exporters of goods and / or services.v Foreign financial intermediaries.