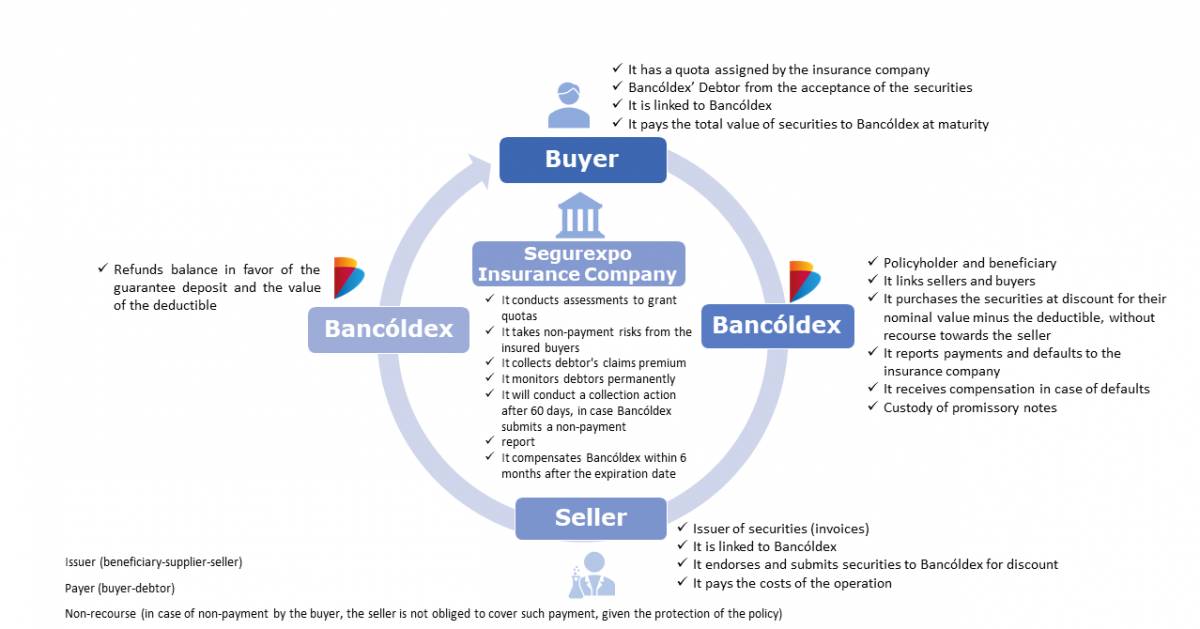

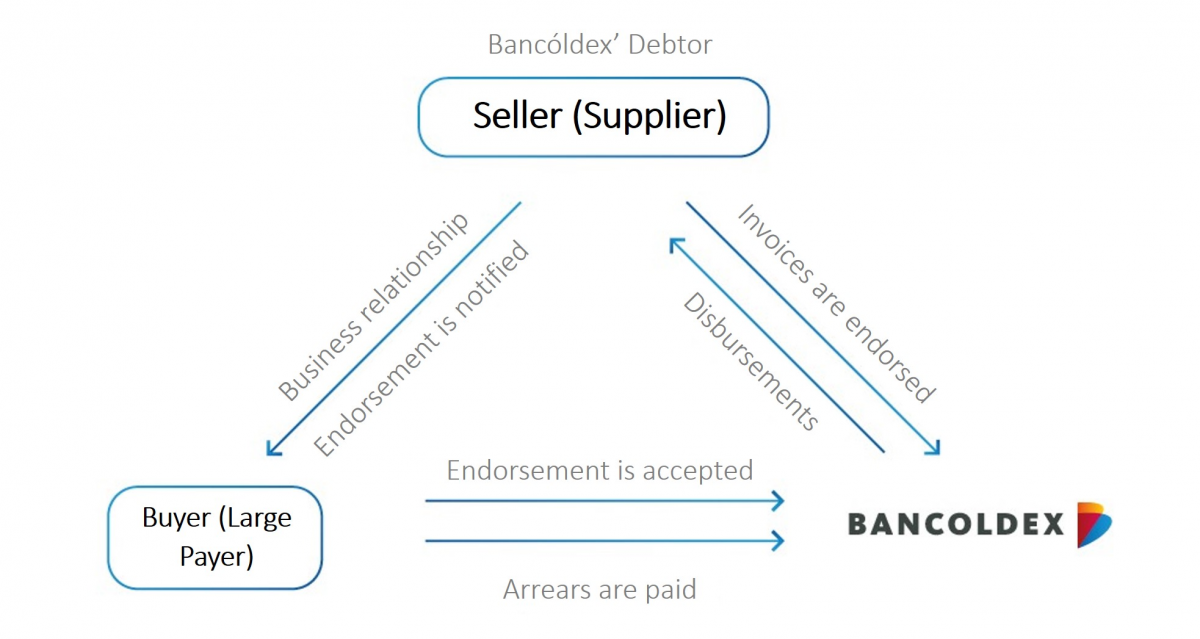

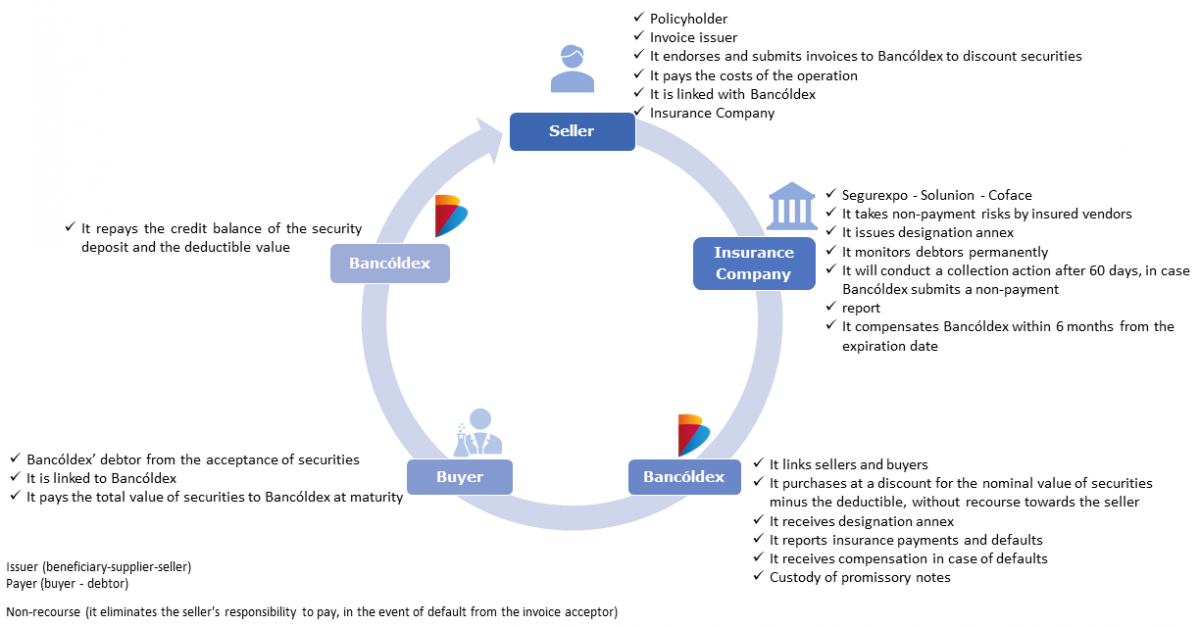

Portfolio purchase at discount from the seller, having previously insured its clients through a portfolio insurance policy. Therefore, it is a product without recourse against the seller.

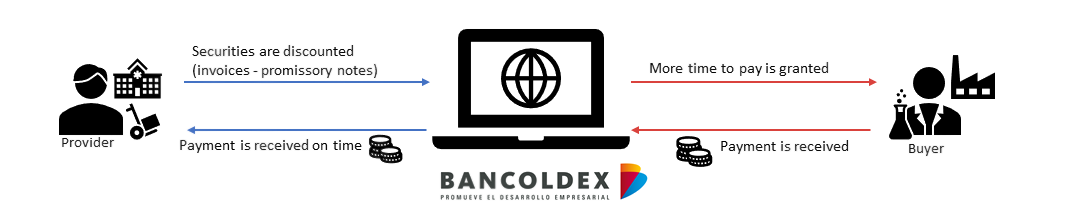

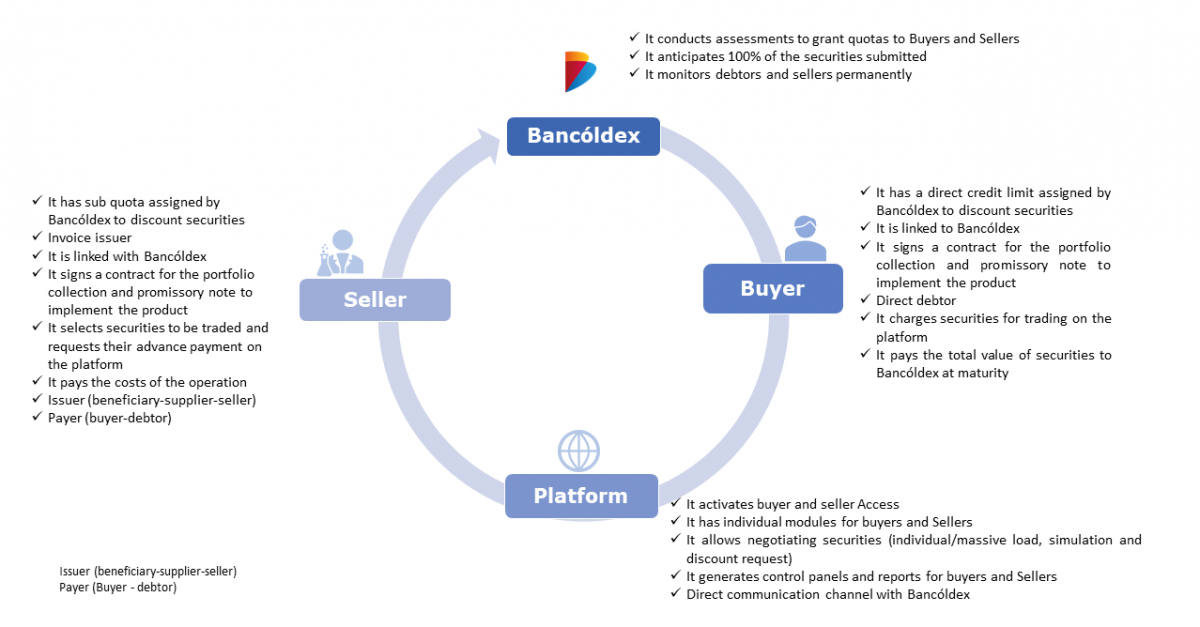

This scheme allows optimizing national suppliers’ resources, by discounting sales invoices and/or bills of exchange, as a result of national credit sales or exports of goods and/or services.

BENEFITS:

- Access with three insurance companies

- Non-recourse discount

- It minimizes credit risk with clients

- It allows negotiating longer payment terms, quotas and sales

- Immediate liquidity

- Credit quotas with commercial banks are not affected

- No additional warranty required

- Maximum term up to 180 days

- Days in arrears are settled at the same discount rate (no moratorium rate is charged)

- Interest rate and access requirements according to market conditions