You are here

If you are looking for long-term financing for business growth, the Private Equity Funds can be an option for you.

What is a private equity fund?

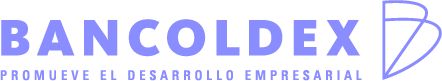

In a few words is an investment instrument into companies.

A private equity fund groups resources of different investors to acquire shares in different companies, to generate value in them, and after a term (5 to 6 years, usually) to sell that participations to make a profit to its investors.

Important: Because private equity funds are looking to invest in companies for a return, these companies must have some basic characteristics, such as:

-

Clear and well-defined market opportunities

-

High potential for growth

-

Innovative products, services and/or business models

-

Clear competitive advantages

-

Be led by an experienced and committed team willing to share strategic decision-making with other stakeholders

Every fund has an expert investment management team (General Partner), who oversees the selection of the companies and projects that receive the fund's resources, always with the aim of obtaining a return from the value generation in them.

What are the benefits of a private equity fund?

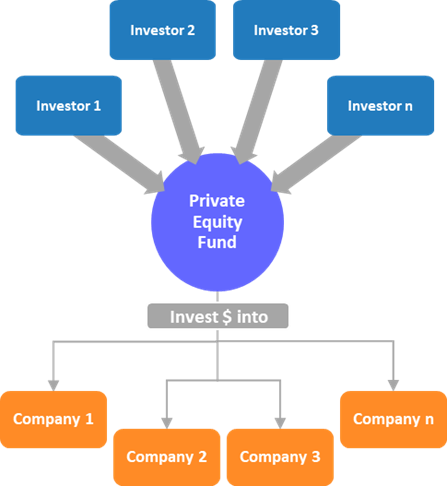

Private equity funds are a strategic ally in the growing path of business.

The companies that receive an investment from a fund additionally obtain a value-added scheme, such as the implementation of good practices in corporate governance, knowledge in human talent management, expansion of business networks, support in business administration, among others

The ultimate goal of any private Equity fund is to create value into the invested companies.

This value-added scheme is also called “smart money”

To learn more about Private Equity Funds and Bancóldex’s role in this industry, we invite you to visit our website:

How can I contact a fund´s General Partner?

As part of Bancóldex's commitment to generate connections between companies and alternative sources of capital, and if you consider that you meet the eligible profile of a private equity fund, we invite you to take the following steps:

1. Fill out this form:

2. Bancóldex shares the completed form with its network of General Partners, and/or other sources of Smart Money.

3. The fund’s General Partners analyze the information, and if they are interested, they contact your company directly.

4. Start the evaluation process established by the fund’s General Partner, under the instructions indicated by it.

Remember: Bancóldex offers the connection solution but does not intervene in the decision process of the Fund’s General Partners nor does it guarantee any kind of investment in the company

Titulo

You may also be interested...

Contact us

Learn more about Bancoldex solution portfolio

Be up to date with Bancoldex