You are here

From our role as a business development bank, at Bancóldex we are committed to fostering economic growth while closing social gaps. In line with this, in March 2022 we launched the "Mujeres Empresarias” (Women Entrepreneurs) credit line. Thanks to the resources provided by the Fondo Mujer Emprende, that reports to the Vice-Presidency of the Republic, we were able to improve the financial conditions of these credits. The line was available to sole proprietors and legal entities that met the established requirements. In this article we would like to focus on the conditions that companies (legal entities) had to meet to access this line and the results obtained.

This was Bancóldex’ first credit line to incorporate the definitions established in Decree 1860 of 2021 of the Ministry of Commerce, Industry and Tourism, which defines what a women's enterprise is in Colombia. As a result, micro, small and medium-sized enterprises wishing to access this line of credit had to meet at least one of the following criteria.

a) Be owned by women with a minimum participation of 30%.

b) A female legal representative

c) At least 50% of leadership positions occupied by women.

d) At least 50% of the company's workforce is female.

It is worth noting that a business could meet more than one condition.

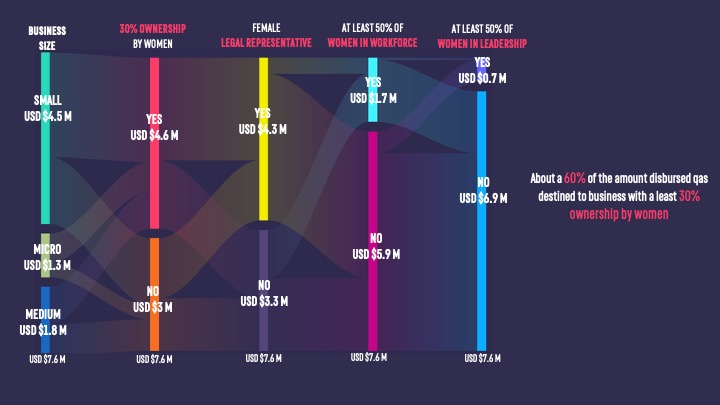

In total, 212 companies with one or more of the above characteristics received US $7.6 million, both for working capital (US $7.1 million) and modernization (US $0,5. million).

Nearly 60% of the US $7.6 millionwere disbursed to firms that were at least 30% women owned. This is evident for all sizes of companies (see graph). Furthermore, of the US $3 million that did not meet these criteria, 53% went to companies that had a female legal representative.

The least frequent conditions met were to have at least 50% women in the workforce and at least 50% of leadership positions occupied by women.

In addition, through our allied microfinance institutions, we reached 686 female microentrepreneurs who received US $1.5 million in disbursements.

This first exercise allowed us to get a first approach to women's businesses in legal entities and to deepen our attention to micro-entrepreneurs. We hope to continue designing products and services aimed at business growth and social development in the country.

Titulo

You may also be interested...

Contact us

Learn more about Bancoldex solution portfolio

Be up to date with Bancoldex